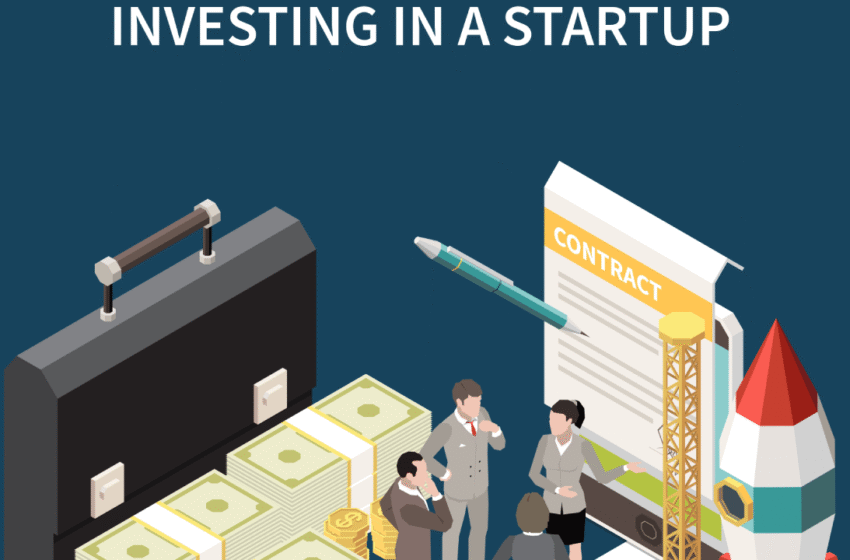

If you’re an entrepreneur preparing to launch your business, you’ve likely come across the many types of startup funding available. Among them, pre-seed funding stands out as the earliest stage of investment. But what exactly does it involve, and how can it accelerate your startup’s growth? In this article, we’ll break down what pre-seed funding is, why it matters, and how you can secure it.

As a startup accelerator, we often meet founders who find the startup funding landscape overwhelming — especially when confronted with new terminology and complex processes. So, let’s simplify things and start from the very beginning.

Why Pre-Seed Funding Matters

Launching a business is no small feat, and one of the toughest challenges entrepreneurs face is securing initial capital. Pre-seed funding is the very first round of financing that helps turn a business idea into a tangible product. As the name suggests, it comes before the seed round and is primarily used to develop a minimum viable product (MVP) or prototype.

At this stage, the focus isn’t on scaling — it’s on validating your idea and creating something investors can believe in.

What Is Pre-Seed Funding?

Pre-seed funding helps startups move from concept to creation. It’s typically used to build prototypes, test the market, and confirm that the business model is viable.

This funding can be allocated toward:

- Hiring early team members or contractors to develop the product.

- Running pilot tests or beta launches.

- Gathering feedback to refine the business model.

The ultimate goal? To reach a point where the startup can demonstrate real traction and secure the next stage — seed funding.

Because startups at this stage often have little more than an idea, securing investment can be tough. However, those who successfully raise pre-seed capital gain a crucial advantage in proving their concept and setting the foundation for long-term growth.

The Role of Pre-Seed Funding in the Startup Journey

Pre-seed funding acts as the bridge between an idea and a working business model. It allows founders to:

- Validate their concept and market demand.

- Develop a functional prototype or MVP.

- Test key assumptions about the business model.

- Build credibility for later funding rounds (Seed and Series A).

It’s often the hardest round to raise — investors are taking a chance on a vision rather than a proven product. But for entrepreneurs who can clearly articulate their mission and potential, pre-seed funding can open the door to future success.

Pre-Seed vs. Seed vs. Series A: What’s the Difference?

| Basis | Pre-Seed | Seed | Series A |

| Stage | Idea / Concept | Product Development | Growth & Expansion |

| Investors | Friends & Family, Accelerators, Angel Investors | Angels, Early VCs | Venture Capital Firms |

| Use of Funds | Prototype & Market Testing | Team Building & Scaling | Market Expansion |

| Average Amount | Up to $500K | Around $4.6M | Roughly $20M |

Each round of funding represents a different phase of growth.

- Pre-seed funds help validate ideas.

- Seed funds help startups scale their teams and launch products.

- Series A funding accelerates business growth and expansion.

On average, pre-seed rounds are under $500,000, while seed and Series A rounds can reach millions, reflecting the increasing maturity and traction of the startup.

Key Benefits of Pre-Seed Funding

1. Accelerating Product Development

Pre-seed funding provides the capital needed to turn ideas into prototypes. Startups can hire developers, designers, and product specialists to build the first version of their offering. With an MVP ready, founders can test the market faster, gather data, and refine their product before scaling.

2. Building a Strong Core Team

A startup’s success depends heavily on its people. With pre-seed funding, founders can recruit skilled professionals or advisors who fill critical knowledge gaps and help execute the company’s vision. Early investment in talent can also attract future investors who value strong leadership teams.

3. Achieving Market Validation

Pre-seed capital enables startups to test their product or service in real-world conditions. Proving that customers want what you’re building is essential for attracting future investment. Early adopters and initial traction serve as proof points that your idea has commercial potential.

4. Attracting Future Investors

A successful pre-seed round signals credibility and momentum. Investors are far more likely to back a startup that already has some funding, a prototype, and positive early feedback. Pre-seed funding helps build this initial trust and can pave the way for larger rounds later on.

Common Sources of Pre-Seed Funding

1. Friends and Family

Many founders begin by raising small amounts from their personal network. Friends and family often believe in the founder’s vision before anyone else does. While this can be an effective funding option, it’s important to set clear expectations and formalize agreements to avoid future misunderstandings.

2. Angel Investors

Angel investors are experienced entrepreneurs or professionals who invest their own money in early-stage startups. In addition to capital, they often bring valuable mentorship and connections. To attract angels, startups must demonstrate a strong idea, a capable team, and high growth potential.

3. Incubators and Accelerators

These programs provide startups with mentorship, resources, and small investments in exchange for equity. Beyond financial support, they offer structured guidance, networking opportunities, and exposure to potential investors. For many early founders, joining an accelerator can be a powerful launchpad.

4. Crowdfunding Platforms

Platforms like Kickstarter and Indiegogo allow entrepreneurs to raise capital directly from the public. Crowdfunding helps validate the idea while building a community of early supporters and customers. However, running a successful campaign requires clear messaging, strategic marketing, and strong storytelling.

5. Government Grants and Programs

Government-backed programs often provide non-dilutive funding, meaning startups don’t have to give up equity. These grants are highly competitive but can be invaluable for startups in tech, research, or social innovation. Applicants need a well-prepared business plan and clear alignment with the grant’s objectives.

The Takeaway

Pre-seed funding is the spark that turns innovative ideas into viable businesses. It empowers founders to test concepts, build teams, and validate markets — all before seeking larger rounds of investment.

When used wisely, pre-seed capital can accelerate growth and set the stage for future success. Founders who can articulate a clear vision, build early traction, and manage resources strategically will have a much stronger foundation for raising subsequent rounds.

Ready to Launch Your Startup?

Take your first step toward growth with RekordistFintech. Our team specializes in helping startups navigate early-stage funding, build technology, and scale effectively. Whether you’re looking for pre-seed funding or end-to-end support, we’re here to help you bring your vision to life.

Let’s build the future together — connect with RekordistFintech today!